Introduction

If you're an investor in France, you've probably come across terms like Flat Tax and the Unique Tax Form (IFU), but what do they really mean? 🤔 Well, don't worry, we're going to demystify all of that! In this article, we'll explore how taxation applies to your investments, particularly with the Flat Tax and the IFU, and how you can optimize your tax declaration to reduce your tax burden. 🌟

What is the Flat Tax (or Single Flat Rate Tax)?

The Flat Tax, or PFU, was introduced in 2018 to simplify the taxation of financial income. This flat tax rate is 30%, and it applies to your investment income such as interest, dividends, and capital gains. Here’s how it’s broken down:

12.8% for income tax (IR)

17.2% for social contributions (CSG, CRDS, and the solidarity levy). 💸

In practical terms, this means that if you earn investment income, you're subject to this simplified tax without needing to break down each type of income.

However, there are opportunities for tax exemptions to lighten this tax burden. We'll explore that in the next section! 👇

Tax Exemptions: How to Reduce Your Investment Income Tax

Although the Flat Tax simplifies taxation, there are tax exemptions that allow you to reduce the bill! 🎉 These exemptions mainly concern income tax (IR) or social contributions.

Exemption from Income Tax (IR):

If your taxable income is less than €25,000 for a single person (or €50,000 for a couple), you can apply for an exemption from income tax. 🎯 This exemption applies only for one fiscal year and must be renewed every year before November 30 to remain valid for the following year. Be sure not to miss the deadline! ⏰Exemption from Social Contributions (CSG/CRDS):

Foreign residents or cross-border workers may be eligible for an exemption from social contributions. This means you could be exempt from CSG (9.20%) and CRDS (0.50%), but not from the solidarity levy. A simple certificate of residency or proof of affiliation with a health system will suffice. 🌍

Document representing IFU

The Unique Tax Form (IFU): Reporting Investment Income

When you receive investment income, you must fill out the Unique Tax Form (IFU). This document is provided by your financial institution and summarizes all the income you've earned. It's like your "tax roadmap"! 📑

The IFU is used to declare your interest, dividends, and capital gains earned during the fiscal year. It's crucial to fill it out properly to avoid mistakes and penalties. 📈

And if you're eligible for any tax exemptions, such as for income tax or social contributions, the IFU will reflect them. It’s handy to make sure everything is in order! 👍

Mistakes to Avoid When Reporting Investment Income

Missing the Deadlines for Declaration: Oops, if you forget to submit a tax exemption request before November 30, you might find yourself with extra charges for the next year. 🚨

Ignoring Possible Exemptions: If you're eligible for an exemption from income tax or social contributions but don’t submit the request, you risk paying more taxes than necessary. 😱

Poor Management of the IFU: If you don't fill out the IFU correctly, it could lead to errors in your tax declaration. Not very fun when it comes to penalties or over-taxation! 😬

Conclusion: Stay Informed to Optimize Your Investment Taxation

The taxation of investment income may seem complex, but with a little attention and preparation, you can easily optimize your tax obligations. 💡 By fully understanding the principles of the Flat Tax, tax exemptions, and the IFU, you’ll be well-equipped to manage your finances efficiently and reduce your tax burden. 🚀

Don’t forget to check each year for your eligibility for tax exemptions and submit your declarations on time! ⏳ If you have any questions, feel free to check out other resources to learn more about the taxation of investment income! 💬

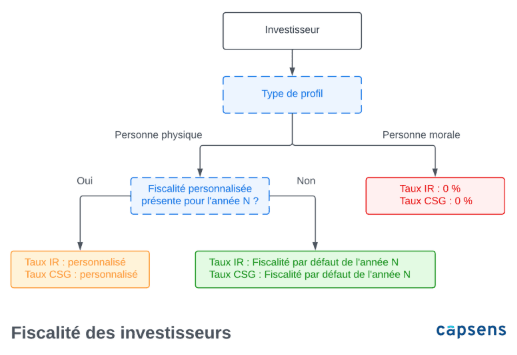

At Capsens, we integrate Flat Tax and IFU management directly into our clients' investment platforms, ensuring optimal compliance and simplified tax management.