What You Need to Know About Asset Management Companies and Investment Funds 🏦

Asset management companies and investment funds play a crucial role in the world of finance. Whether you're a seasoned investor or a beginner, understanding how they work can help you make informed decisions and optimize your investments. Let’s take a look at what you need to know about these key players in the market! 💡

What is an Investment Fund? 💰

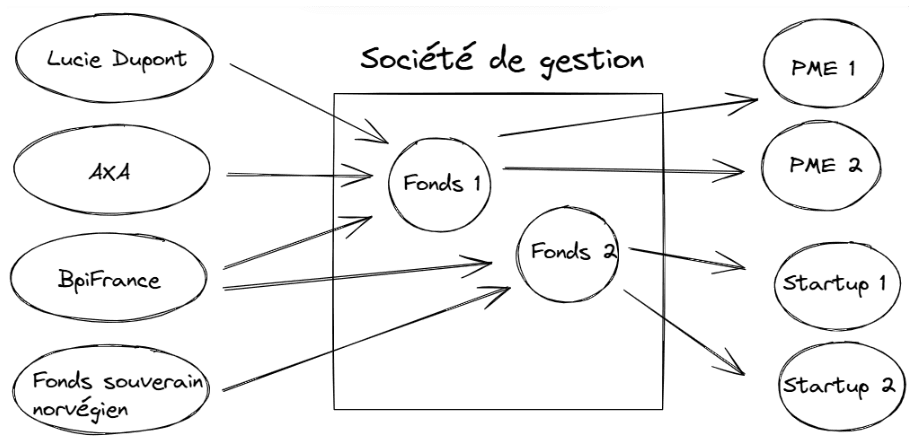

An investment fund is a financial vehicle that allows multiple investors to pool their money together to invest in promising projects. In the case of private equity funds, the goal is to support companies that are not publicly traded. Unlike funds that invest in the stock market, these funds focus on private companies, often with high growth potential.

Why invest in these funds? Here are a few reasons:

Delegate investment decisions: You entrust your money to experts.

Diversify your investments: A fund invests in multiple companies, thus reducing risks.

How to Invest in an Investment Fund? 📈

There are several ways to participate in these funds, either directly or through specialized structures.

1. Via an Asset Management Company 📊

Asset management companies are the entities responsible for managing funds. They select investments, manage portfolios, and ensure their profitability. In general, they are authorized by the AMF (Financial Markets Authority) to ensure compliance with regulations. Institutional investors (banks, insurance companies, etc.) often invest directly through these companies.

2. Via a Wealth Management Firm (CGP) 🧑💼

Individuals often prefer to go through CGPs. These firms help optimize tax strategies and select the right investments based on the investor's profile. They also provide easier access to asset management companies while handling administrative procedures (KYC, subscription, etc.).

3. Feeder Funds (Funds of Funds) 🍽️

Feeder funds are an excellent solution for investors with smaller budgets, allowing them to invest in more exclusive funds (such as Ardian or Goldman Sachs), which have high entry tickets. These funds pool the investments of several small investors and manage the subscriptions for them.

Key Terms to Know 🔑

To navigate the world of investment funds smoothly, it’s essential to understand certain specific terms. Here are a few of the most important ones:

LP (Limited Partner): These are the investors who place their money into a fund.

Capital Call: A process through which the fund asks investors for additional funds to finance new investments.

Private Equity: Investments in private, non-publicly traded companies.

Net Asset Value (NAV): The value of one share of a fund, which fluctuates depending on the performance of its investments.

At Capsens, a web agency specialized in fintech, we help management companies and funds to develop digital solutions allowing them to ensure the best possible customer experience while remaining transparent.