Related articles

Discovering loans between individuals via financing platforms

Unforeseen everyday situations can sometimes require the use of relatively large funds. However, turning to family, friends, or co-workers can sometimes be very awkward. The choice to go to the bank or a financing institution is an expensive choice that does not always offer the expected satisfaction. The guarantees to be offered are numerous and the interest to pay can be disheartening. To effectively overcome these problems, financing platforms for loans between individuals today represent an excellent compromise and an alternative to banks for fast and low-cost loans. What can we say about the loan between individuals made through financing platforms? Details in this article.

What can we say about loans between individuals via a credit platform?

Loans between individuals via a credit platform are comparable to bank loans. It connects two parties with complementary needs: individuals in need and others looking for an investment for more profitable savings. This type of credit requires the payment of interest costs just like at the bank and has many advantages. However, it is important to beware of scams and to choose a peer-to-peer lending platform reliable, secure and recognized.

How does the loan between individuals work

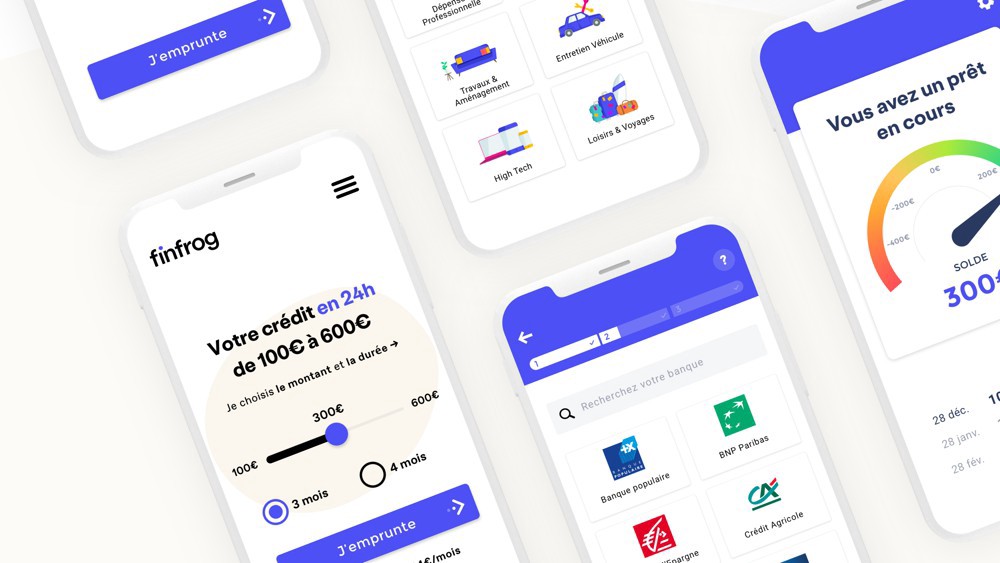

The process for obtaining a loan between individuals on a responsible and reliable platform is simple and fast. With Finfrog for example, which is a platform for Peer-to-peer lending recognized in France, the loan request is made entirely online with an answer given within 24 working hours following the submission of the request. Loans are spread over a short period of 3, 4 to 6 months. The system set up by this platform is efficient and secure. In fact, Finfrog works in close collaboration with MangoPay, a most efficient and used online payment system.

These loans are perfect for solving unexpected events such as a bank overdraft to be filled, a car breakdown, a health problem or a small personal project.

What are the advantages offered by loans between individuals?

Opting for a loan between individuals online is an excellent option when this loan is taken out through a quality platform. This type of loan has advantages for both the borrower and the lender. Opting for a loan between individuals online is a simple and fast way to obtain credit. Long administrative procedures and multiple appointments are avoided; most importantly, the cost of loans made through these channels is much lower than those generated during credit procedures contracted in traditional credit organizations.

The advantages of loans between individuals for investors

For investors, loans between individuals represent a real bargain. They are open to people who are at least 18 years old, have a bank account in the European Union and of course have a minimum amount required by the platform concerned. The advantages offered by this type of investment are numerous:

- Attractive and very satisfactory returns : investing on a secure online credit platform is an effective way to make your savings work and earn significant annual interest;

- A quick and free investment : to invest on a platform for loans between individuals, the procedure is simple. You will only have to register for free by following the conditions established by the platform of your choice and to offer your services without any delay;

- Investments that match your possibilities : the vast majority of online credit platforms allow investments with very low amounts. So, there's no need to own a fortune to get started. You can invest from 10 euros and increase your bet as you go. This investment is open to everyone and is an excellent choice to make your savings work;

- Secured investments : loans between individuals also offer very good guarantees. The risk of losing your investment is therefore moderate compared to several other types of financial investments.

Crowdfunding and loans between individuals: what difference to make?

Surely you have already heard about crowdfunding. This is a type of loan between individuals whose financing method differs from that implemented by peer-to-peer lending sites as defined up to now. Indeed, to benefit from crowdfunding, it is necessary to present an innovative, interesting and absolutely creative project. The crowdfunding platform is therefore responsible for presenting your project to interested investors. If it receives attention, it can be financed according to various modalities selected. A donation, a loan, a capital increase: the terms and conditions are numerous and attractive.