Related articles

Why you need to digitize your investment fund

At CapSens, we work for several investment funds including Idinvest, famous for funding startups (Meero, Payfit, October,...), INCO, famous for funding social business startups (Simplon, LITA.co, ETIC,...) or French banks (Société Générale, Arkea, Caisse d'Épargne,...)

These structures, founded about twenty years ago on average, work a lot on their network to identify the targets of their funding.

Kima Ventures has thusremoved the “apply” pageof its website

The importance given to the employees of the structure rather than to procedures or the need to quickly position themselves on a deal are all reasons why investment funds have not invested in their own digitalization. Indeed, it is complex to digitize a structure with few processes.

However, three factors currently push them to automate processes using digital tools:

- The funds have grown, reaching a size that involved more rigorous processes,

- Competition has increased. Eldorado now has 400 investment funds in France,

- The regulation is more stringent concerning investors (for funds that collect from the “general public”): information obligation, classification of investors, FATCA, etc.

Let's get along,Digitizing does not mean 'using digital tools', but use them at scale and strategically. Because simply sharing your data on Dropbox, communicating with Slack and following your CRM on Google Doc is not a good use of digital technology with 5 employees.

Here are the various elements on which we are seeing major digitization efforts and on which we are working at CapSens : firstly, we present here the elements related to dealflow and secondly those related to the investor relationship.

Dealflow and portfolio monitoring

In a fund, the Analysts meet entrepreneurs, follow them from project to project, do not see them again for several months, collect a lot of information, and must coordinate within their structure.

A lot of funds use a shared Excel spreadsheet to track this with fields in columns such as:

- About the company: Company name, address, name of the manager, development phase (start-up, acceleration, development), development phase (start-up, acceleration, development), date of creation, legal status, SIRET, NAF code, business sectors, sectors, indicators, activity, telephone, contact, contact, contact, email, telephone, contact, contact, email, telephone, contact, contact, email, website, website, website, business provider, CA, REX, number of employees, etc.

- About investment to come into the company: status of the investment (identified, to be presented in committee, on pause, due diligence, closing in progress, closing on pause, in portfolio, abandoned with the reasons for the abandonment), total amount sought (or raised), amount for the fund, amount for the fund, probability of realization, probability of realization, due diligence, due diligence, due diligence, due diligence, due diligence, closing in progress, due diligence, closing in progress, type of financial instrument (Shares, BSA, bonds,...), Bpifrance guarantee, guarantee date, other guarantees, amount for the fund, probability of completion, probability of completion, type of financial instrument (Shares, BSA, bonds,...), Bpifrance guarantee, date of guarantee, other guarantees, date of the investment, amount actually invested, etc.

- These Excels (or Google Sheets) are very practical because they are flexible: it is easy to add calculations and columns, however This is causing a lot of problems at scale : duplication and dated versions, overwriting formulas, modifying the template by collaborators, forgetting to fill it in, absence of automated actions.

Here's what you can do simply by developing your own tool. CRMs, on the other hand, are not flexible enough to achieve this:

- Each user has an account, which allows trace actions, to give differentiated rights according to the type of user and to assign folders.

- Analysts receive automatic emails configurable. These can be reminders (when a company has been “on pause” for more than 2 months), reports (every Monday I receive a summary of the changes made last week), notifications (the company you are following has been due diligence by this user).

- Connecting to External APIs: Google maps, Salesforce, Airtable, Airtable, Info,... to send information or retrieve it automatically.

- Follow-up of quarterly figures portfolio companies.

- Exports: of course Excel exports are always possible just in case, but also exports formatted in PDF for reports.

- Third-party access: to give access tochartered accountant, or to investors. They'll only see what you want them to see: a selection of data or a summary.

- La Data visualization consists in communicating figures or raw information by transforming them into visual objects: diagrams, diagrams.

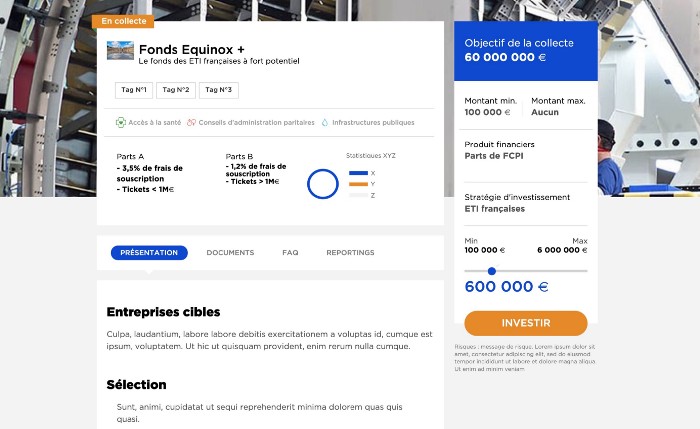

KYC and online subscription

In view of the high amounts of subscriptions accepted (€20,000 for the smallest tickets for some VC funds and several million for others) Funds have long preferred to manage investments by hand.

If he puts in €500,000 we can talk to him for 30 minutes on the phone to help him.

This statement is completely false. because:

- An investor does not necessarily like Take 30 minutes to talk about ID and checkboxes in a form. He will prefer to do this online if it is done well.

- As complex as the regulations may seem, it can be integrated into a platform with conditions that only apply in appropriate cases. And that's a lot of time saved for the fund.

- Better to pass 30 minutes on the phone to defend your investment strategy and talk about track records or the history of a fund only to talk about “Form W-8BEN-E”.

- Here's what you can do simply by developing your own tool:

- Enroll investors (natural and legal persons) online by starting by asking them for identity information, family situation, FATCA, professional situation, financial profile, financial situation and financial knowledge as well as investment objectives.

- Make some conditional fields: if he says that he is married the form adds the question of the matrimonial regime and if he says “Universal Community” or “Community reduced to acquets” the form will ask for the spouse's profession. It is possible to go further to cross the income, the assets and the amount that the investor wishes to invest.

- Block or correct wrong answers directly rather than receiving forms that were not filled out incorrectly.

- From the fields filled in automatically generate a subscription form ready to sign. It is signed online via a service such as Universign by an SMS sent to the subscriber.

- The subscriber does not have to fill in their personal information again and upload supporting documents for future subscriptions. In addition, he finds online its history, its signed documents etc..

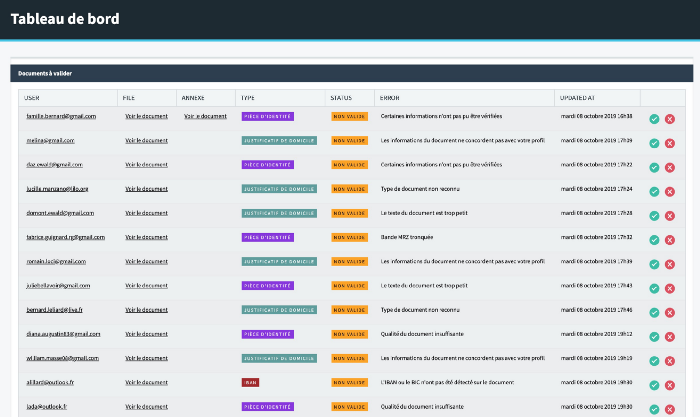

- In the back office the files are classified according to their status of progress.

- Automated parts control via the automatic image reading (OCR) by the Netheos PreventGo API for example.

- Automatic reconciliation of transfers received after calling for funds.

Investor performance monitoring portal

Here too it is about save teams time funds (“client servicing”, “sales”,...) so that they spend time on what is valuable. We are developing portals so that investors can find:

- Les past performance according to the type of shares owned by the investor. Connect with Morningstar to retrieve data and notes.

- Investment and fund raising simulations, from N to N+10, by simulating what the current funds in the portfolio will call and distribute in the future.

- Database containing all documents relating to investors and their investments: annual accounts, reports, fund regulations, prospectuses, subscription forms, fund call and distribution instructions, capital account statements, capital account statements, annual fund accounts, etc.

Wealth Management Advisor Portal (CGP)

Entangled in increasingly time-consuming regulations, CGPs appreciate tools that facilitate their work. Here is what can be implemented so that they get their customers to subscribe to the funds:

- Access to CGPs forKYC tool and online subscription. Thus, in the presence of its client, the CGP fills in all its client's information from its online space.

- Follow-up of customer subscriptions and Commission monitoring and their payment from the fund.

- View of funds that the CGP does not have distribution agreement and possibility to ask for them.

- The offices of CGP Subscriptions are divided between advisers.

- Access to the tools of Wealth simulation.

- Special format tablet and offline access to some of the functionalities of the portal.

It is important to understand that we make all these tools tailor-made according to the needs of our customers, because they are all specific. However, we create and use code “bricks” (called “gems” in Ruby) that allow us to speed up developments and limit technical risk.

For more information: nicolas@capsens.euNouveau Slack integration service with Qonto