Optimize Your Expenses with the Innovation Tax Credit (CII) 🚀

The Innovation Tax Credit (CII) is a tax scheme that allows businesses to benefit from a tax reduction to fund their innovative projects. This credit is a real opportunity for SMEs (Small and Medium-sized Enterprises) investing in creative and innovative solutions. But how does it work? And how can your web agency help you take advantage of it? Let's explain everything! 💡

What is the Innovation Tax Credit (CII)? 🏷️

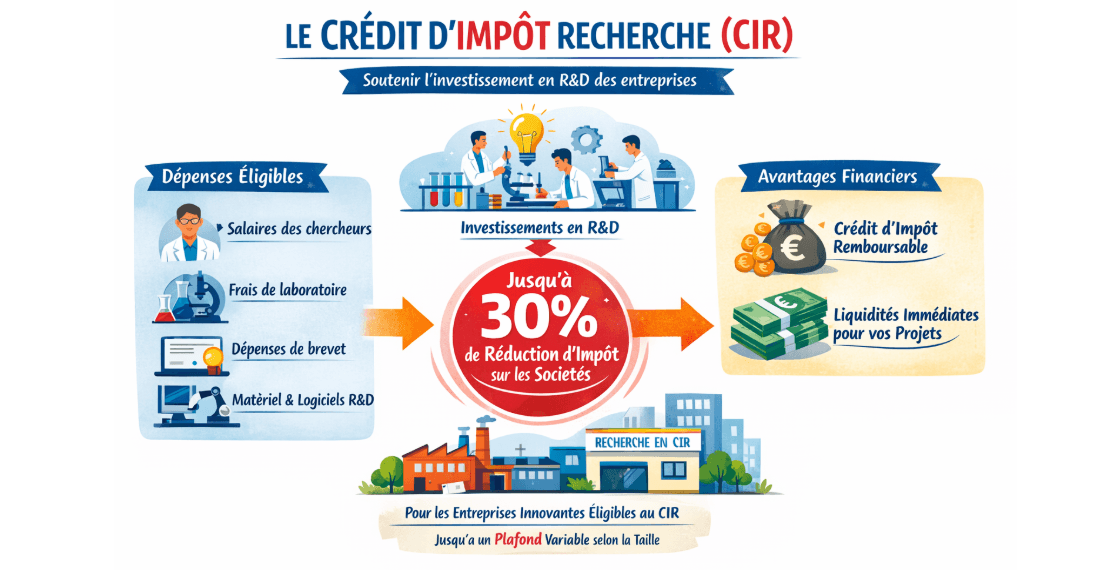

The CII is a tax credit granted to businesses carrying out innovative projects. In practical terms, it reduces corporate income tax (CIT), with the possibility of a refund if the amount of the tax credit exceeds the tax due. In practice, a business benefiting from the CII can recover up to 30% of its innovation-related expenses, with a ceiling of €120,000 per year.

But what is considered "innovation" in this case? For a product to be considered innovative, it must meet two essential criteria:

It is not yet available on the market.

It must offer superior performance compared to existing products in terms of technical features, ergonomics, or functionality.

It is important to note that innovation must be commercializable. For example, if a company develops an internal tool, it will not be eligible for the CII. A project that remains strictly internal to the company cannot benefit from this aid.

Who can benefit from the CII? 👥

The CII is intended only for SMEs. A company must meet several criteria to qualify:

It must be based in France.

It must not be owned by a foreign group.

The projects being financed must be considered innovative according to CII criteria.

This is where a CII-approved web agency, like Capsens, comes into play. If you are working on innovative digital projects with a CII-approved agency, you can include their services in your CII calculation to benefit from the tax reduction. This applies to both web development work and technical innovation consulting.

How is the CII Calculated? 📊

The amount of the Innovation Tax Credit is equal to 30% of the innovation expenses incurred during the year, up to a maximum of €120,000 per year. This credit is therefore capped based on the expenses.

Here’s a simple example:

A company spends €500,000 on an innovative project.

30% of this amount (€150,000) can be considered for the CII.

However, they can only benefit from €120,000, the maximum ceiling set by the CII.

Expenses included in this calculation are numerous:

Salaries of employees dedicated to the project.

External expenses (such as services from a CII-approved web agency).

Depreciation costs for equipment used for the project.

The CII Approval for Capsens and Our Clients 🤝

Capsens has obtained CII approval, which means that our clients' expenses on innovative projects with us can be included in their CII application. This approval is great news for our clients, as it allows them to recover part of their expenses in the form of a tax credit, significantly reducing the net cost of their innovation projects.

What Does This Change for Capsens 🔄

For Capsens, this approval means that we must now be more precise in billing certain items. Our clients will sometimes need to see specifically which services are directly related to innovation to justify their tax credit. It’s also a great argument to offer web development services at a lower net cost while ensuring that our clients benefit from a substantial tax reduction.

In Conclusion ✨

The Innovation Tax Credit is a golden opportunity for SMEs to fund their innovative projects while reducing their tax burden. For businesses working with CII-approved web agencies, like Capsens, it’s a real chance to reduce the cost of their digital developments and move their projects forward while optimizing their tax strategy.